Wholesale

Best Warehouse Layout Strategies for Effecient Inventory Management

Imagine every misplaced item or poorly arranged space causing delays, unhappy workers, and lost chances. But what if your warehouse...

What is Inventory Turnover and How to Calculate it?

Wholesale

Ever wondered how efficiently a business is moving its stock? That’s where inventory turnover ratio (ITR), or simply inventory turnover, comes into play.

This nifty metric is a clear indicator of how quickly a company sells through its inventory. Think of it as a health check on a business's sales efficiency.

In this article, we'll dive deeper into what makes inventory turnover a critical measure for any business, show you how to calculate it and discuss strategies to optimize your inventory levels.

Inventory turnover is a financial ratio that shows the number of times a company has sold successfully and replaced its inventory throughout a given period of time.

It’s a handy tool for understanding how well a business is managing its stock levels.

Think of it like this: if you own a clothing store, the inventory turnover ratio tells you how many times your entire stock of jackets, jeans, or shoes gets sold out and restocked within a year.

The inventory turnover formula helps to divide this period into days and show how many days it takes for a company to sell through the inventory it has on hand.

Inventory turnover can be calculated by dividing the cost of goods sold (COGS) by the average inventory during a specific time frame.

Formula: Inventory turnover = [Cost of goods sold (COGS)] \ [Average inventory]

Let’s break it down:

For example, if your COGS for the year is $500,000 and your average inventory is $100,000, you inventory turnover ration is 5, meaning you sold and replaced your entire inventory five times in that year.

Calculating inventory turnover can shed light on various critical aspects of your business:

High inventory turnover is generally seen as a positive sign. It often indicates that a company is efficient and financially healthy.

You would want to keep your inventory turnover at a high level for the following reasons:

Low inventory turnover can be a red flag for several issues within a business. Let’s break down what this means and why it’s important to keep an eye on it.

When a business has a low inventory turnover rate it can signal the following:

Poor sales performance

When inventory turnover is low, it might signal that sales aren’t happening as fast as they should be. This can stem from:

Holding onto too much stock

Having too much stock can lead to unwanted consequences as well:

Not meeting customer demand

Low turnover may also indicate you’re not effectively meeting what customers want. This could be due to:

It is hard to say what is a good inventory turnover rate for a business as it is highly dependent on the market it operates in and the type of products it is selling.

For example, an automobile manufacturer will have a lower inventory turnover rate than a company that is selling fast-moving consumer goods.

This is because consumers tend to purchase low-ticket items much faster than more high-ticket items where they need time to make a purchasing decision.

For this reason, inventory turnover rates can only be assessed when industry average and competition are taken into consideration as well.

In general, businesses are aiming to have their inventory turnover rate between 5% and 10%.

Deadstock is also referred to as obsolete inventory and is used for inventory that has not been sold or used for a considerably long time and is not expected to be sold in the foreseeable future.

Unfortunately, this type of inventory can cause large losses for a company and needs to be written off or written down.

In today’s highly competitive market where consumers are better informed and have a higher expectation of the products they are offered, the product life cycle tends to be shorter and inventory tends to become obsolete much faster than before.

Boosting your inventory turnover isn’t just about selling more—it’s about selling smarter and managing your stock more effectively.

Here are some practical strategies to help you enhance your inventory turnover and keep your business running smoothly:

Regularly review your inventory to identify items that haven’t been selling in a while.

One effective way to improve inventory turnover is to regularly review your stock levels. Pay special attention to items that have been sitting in inventory for an extended period.

These items, often referred to as deadstock, can tie up valuable resources and capital that could be better used elsewhere.

By identifying these underperformers, you can take steps to address why they aren’t selling.

Is it a pricing issue? Poor product visibility? Or perhaps it simply doesn’t resonate with your target market?

Once identified, you can make informed decisions—whether that’s adjusting promoting strategies, repositioning the product in-store, or even repurposing the items to better meet consumer needs.

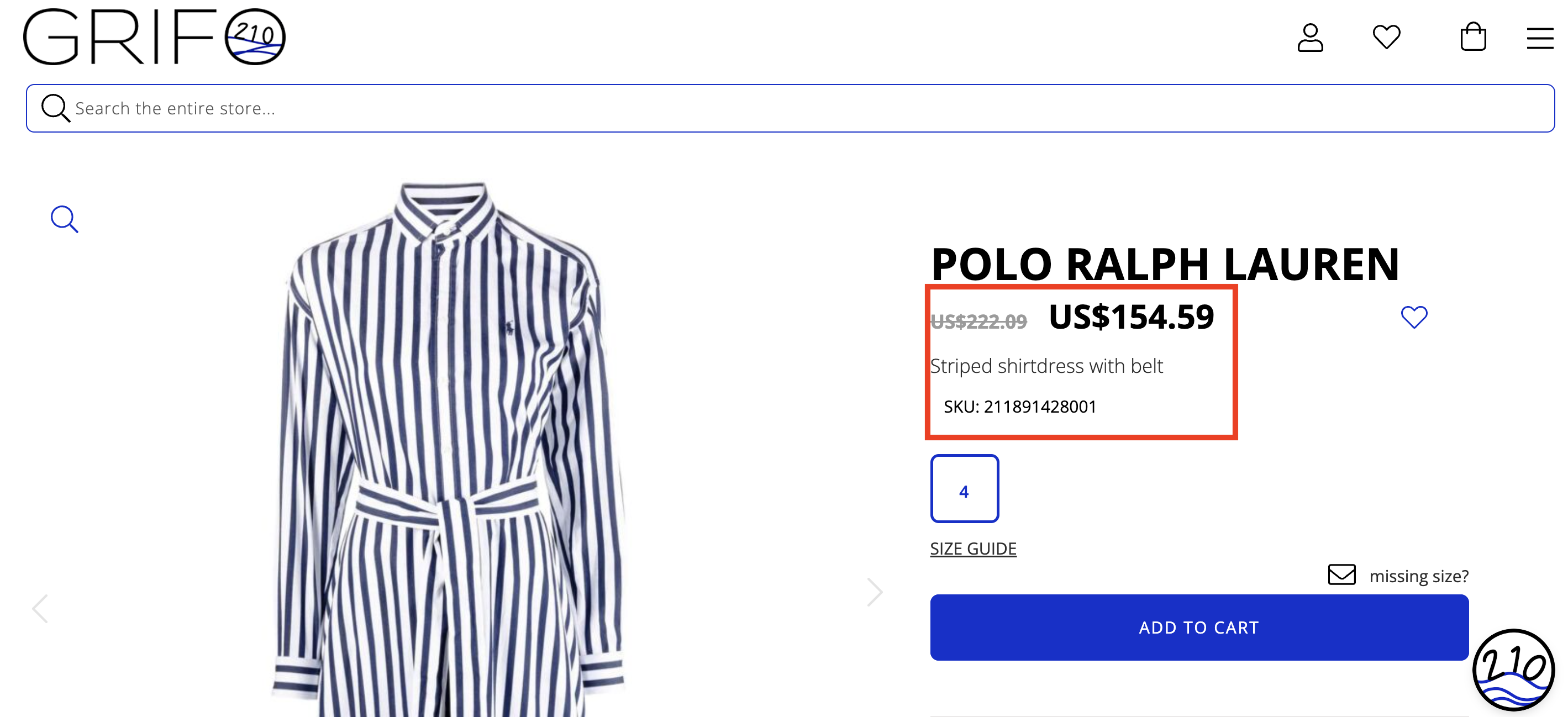

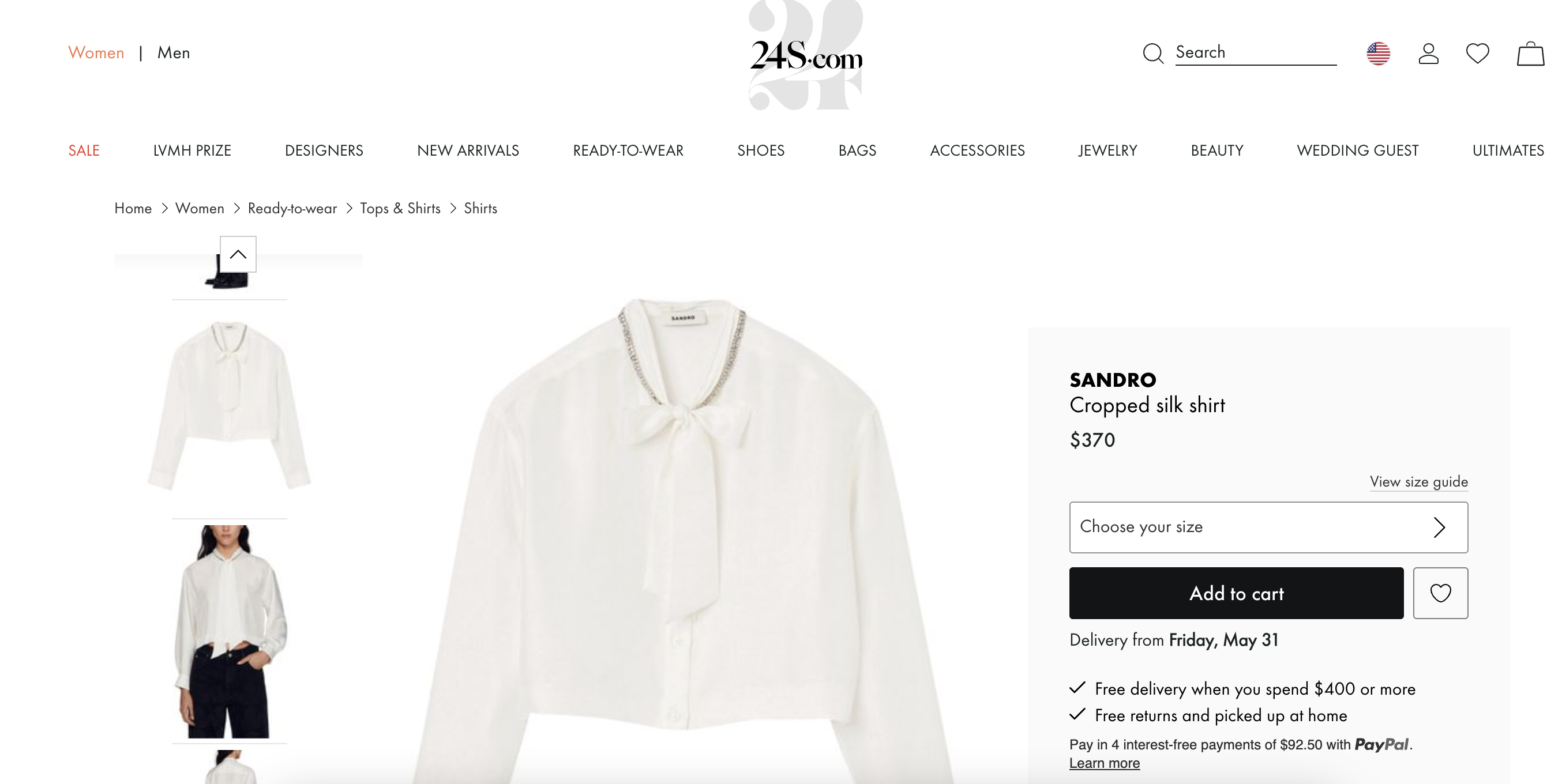

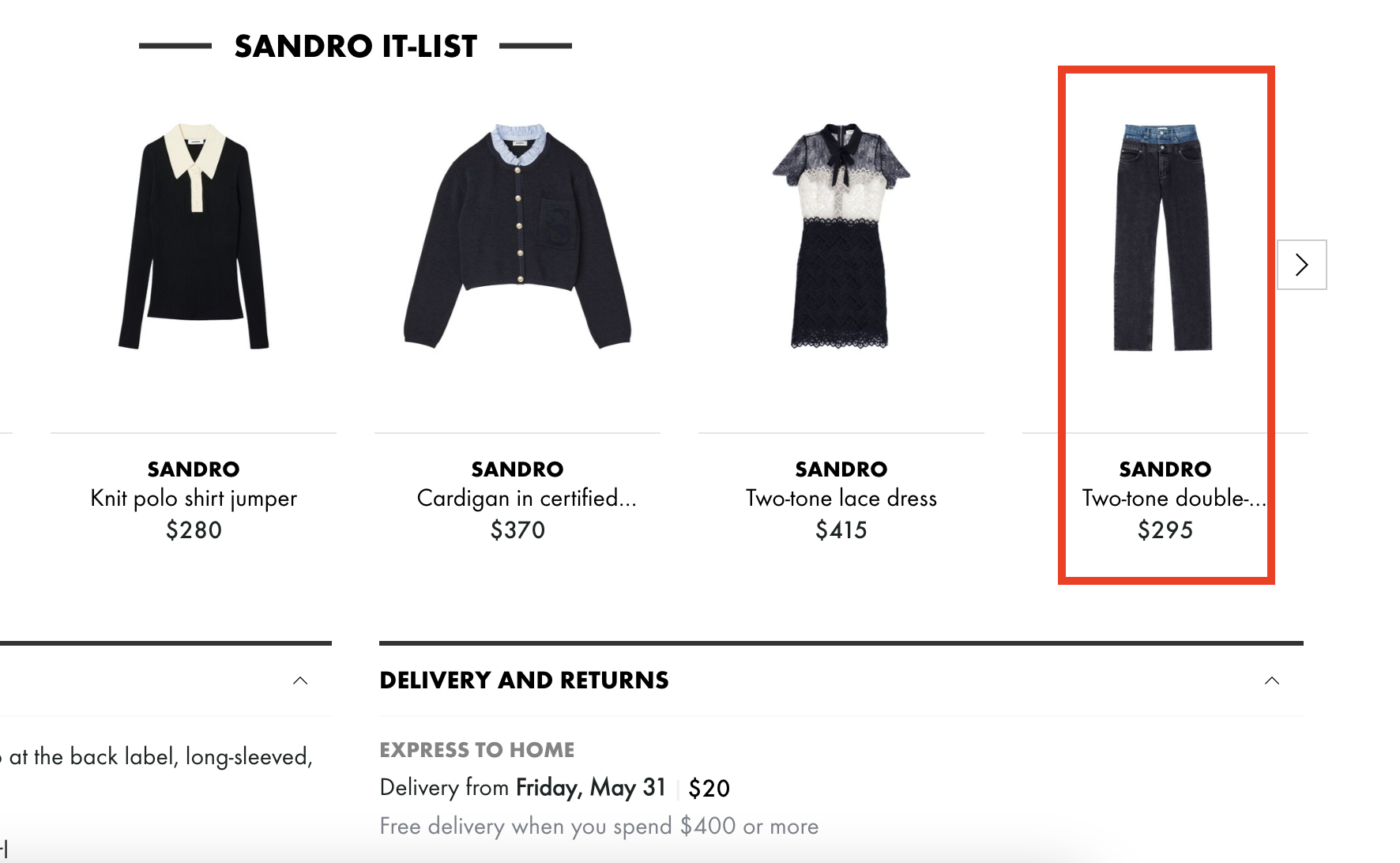

For example, a clothing retailer might notice that a particular style of dress isn’t selling well and could consider marking them down or displaying them more prominently to increase visibility.

Offer discounts or bundle deals to move deadstock quickly.

To clear out slow-moving stock and improve the inventory turnover ratio, consider implementing discounts or creating bundle deals.

This strategy can be particularly effective during peak shopping seasons or in conjunction with marketing campaigns.

For instance, you could cross-sell or upsell a slow-selling shirt with a popular pair of pants at a discount, offering customers a perceived higher value while clearing out older stock.

Additionally, flash sales or limited-time offers can create a sense of urgency, encouraging customers to purchase before the deal expires.

This approach not only helps move stale inventory but also engages customers and can drive additional foot traffic to your store or website.

Leveraging sales data and market trends can significantly enhance your inventory forecasting, which is crucial for maintaining optimal stock levels.

By analyzing which products sell during certain periods or in response to specific trends, you can make more accurate predictions about how much stock to order and when.

For example, if data shows that sales of certain outdoor apparel spike in the early summer, you can ensure that you have adequate stock of such summer products leading up to this period.

Advanced forecasting techniques, such as Google Trends and AI tools, can help predict future trends with greater accuracy.

This proactive approach not only prevents overstocking but also ensures you don’t miss out on potential sales due to understocking.

Understanding and calculating the inventory turnover ratio (ITR) is crucial for any business aiming to optimize its inventory management.

This metric provides insights into how effectively a company is selling its products, directly impacting sales strength and overall business performance.

It’s always better to plan carefully and only purchase the amount of inventory you are confident you can sell out based on current trends and consumer behavior.

In that way, you not only maintain a healthier cash flow but also enhance your operational efficiency.

What is dropshipping?